American Farriers Journal

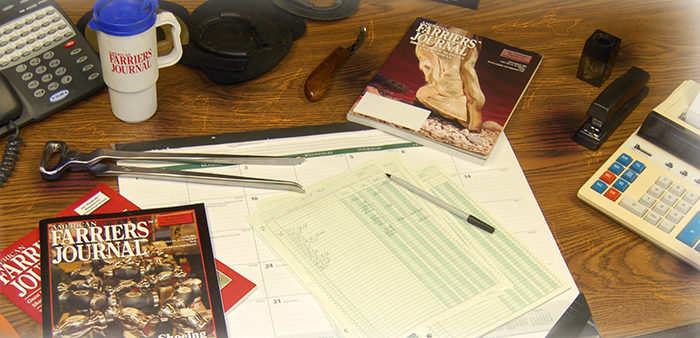

American Farriers Journal is the “hands-on” magazine for professional farriers, equine veterinarians and horse care product and service buyers.

Even if you love shoeing for a living, remember that you’re in it for the money, warns farrier Brian Robertson of Owosso, Mich. “When you wake up in the morning, you have got to be a businessman; from the minute you wake up until the minute you are off the clock,” he says.

Robertson started shoeing horses in 1971 and made it a full-time career in 1973. He remembers the mentality of the not-so-good old days when many farriers enjoyed the freedom of their chosen work, only to find that independence didn’t pay the bills. “Thirty years ago, horseshoers were gods, or thought they were gods. They had that alternate lifestyle. They were out of corporate America and out of hourly jobs,” he says.

But if farriers think they’ve left the business world behind, they’re doomed to fail, and most of them do, he adds. “They don’t fail because their product or service was bad, they fail because they are poor businessmen. Being a successful shoer requires more than having a spouse with a great job. If that’s your plan, you are in serious trouble. Basically, you’re subsidizing the horse industry,” he says.

Robertson offers detailed advice about succeeding as a horseshoer. It begins with recognizing that farriery is a service business, no more and no less.

“All the rules of business apply. If you don’t follow good business practices, you are going to fail,” he says. “You can be the best horseshoer in the world, but if…