Advertise Follow Us

Home / Keywords / reporting state internet taxes

Items Tagged with 'reporting state internet taxes'

ARTICLES

State-specific internet tax regulations are increasing competition, but costing more time and money

Read More

Top Articles

Current Issue

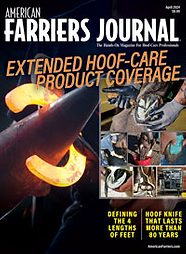

American Farriers Journal

American Farriers Journal is the “hands-on” magazine for professional farriers, equine veterinarians and horse care product and service buyers.

A Cost-Effective Way to Fight Equine Hoof Diseases

What are the 4 Lengths of Horses’ Feet?

Does New Labor Rule Alter Your Multi-Farrier Practice?

Current Issue

Special Report For Equine Veterinarians

American Farriers Journal is the “hands-on” magazine for professional farriers, equine veterinarians and horse care product and service buyers.

Must Read Free Eguides

Download these helpful knowledge building tools

- Caring for Your Horse During a Pandemic

- CBD Products Have Promise for Farriers, but Buyer Beware

- Sharpening Knives with a Buffer

- Winter Hoof Care

Videos

Farrier Education: Heartland Horseshoeing School

Farriery requires knowledge and skills to provide proper equine hoof care. In this series, sponsored by VICTORY, American Farriers Journal visits Heartland Horseshoeing School in Lamar, Mo. In this edition, Chris Gregory discussed his journey to becoming an educator, his focus in teaching farrier students and the state of farrier education.

Events

EMS (IR) and PPID: Diagnosis and Management (Part 1) Webinar

Date: 02/26/24

Location:

View Event

Top Directory Listings

Life Data Labs Inc

Life Data Labs Inc. is a dedicated product manufacturer committed to producing premium quality animal nutrition and health products through continuous product improvement and new product development. First-class ingredients, fresh products, consistent high quality and scientifically proven effectiveness are the principal features of Life Data Labs animal health products. And that's why they've produced the #1 recommended hoof supplement by farriers for 12 consecutive years.

Kawell USA

Kawell develops and produces copper alloy horseshoes and inserts, giving horses the care that they need to fight issues associated with white line disease, seedy toe and thrush.

SmartPak

From the feed room to the tack room, SmartPak offers innovative solutions to help riders take great care of their horses. SmartPak was founded in 1999 with the introduction of the patented SmartPak™ supplement feeding system. The revolutionary, daily dose SmartPaks are custom-made for your horse, individually labeled and sealed for freshness.