Shane Westman

As much as farriery is art and science, it’s also a business. No matter where you are in your career, you need a plan.

“It’s really important at the beginning of your career, at the mid-stage of your career and toward the twilight of your career to always have a plan,” Bow, Wash., farrier Shane Westman told attendees of the American Association of Professional Farriers (AAPF) Hoofcare Essentials Clinic at Life Data Labs in Cherokee, Ala. “A business plan is a road map for your business life. It helps guide you in making your decisions.”

Your plan should plot where you want to be at various milestones of your career — 5 years, 10 years, 15 years, etc.

“When I started out as a farrier, I had some business experience, mostly in the retail industry,” says the AAPF board member. “I knew that after a year, I wanted to make $100 a day. That was my goal. In 3 years, I wanted to be set with my clientele. In 5 years, I wanted to close my book. In 10 years, I wanted to hire employees. In 20 years, I wanted to have a multi-farrier practice.”

Westman has been shoeing for about 23 years and hasn’t attained all of his goals. That’s OK, he says, changing plans are part of the business.

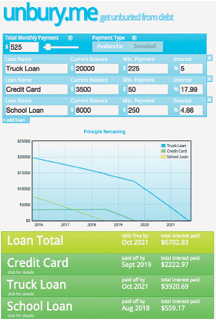

Unbury.me helps you determine which method to use to eliminate your debt.

“I’m still a solo practice,” he says. “I’m not shoeing high-profile horses, although I hope to do so with my revised plan. I do backyard horses and I love it. My clients are a fiercely loyal bunch and I’m really proud to do it. I try to provide a top-notch service, a high-quality service to the everyday person.”

Although his plan has changed along the way, it must be remembered that it’s a guide, not a rule.

“I don’t charge the most, but my plan was to manage my money the best,” Westman says. “That’s why I’m successful. Goals are subject to change. Start your 1-year plan over again.”

When mapping out your goals, it’s important that they are clearly defined and within reach.

“You don’t want to set a goal of shoeing Olympians within 3 years of starting your career,” Westman reasons. “That’s not going to happen. Make your goals attainable. When you attain small personal victories, it makes you feel really good. It keeps you fired up in your career.”

Emergency Savings

Another timeless business necessity that no farrier should be without is an emergency savings account.

“The most important thing I can tell any farrier is you need emergency savings now,” he implores. “That’s not your vacation fund or $100 in the bank. You need to have some living expenses set aside in a separate account, away from your spending money.”

Don’t let the word “emergency” throw you. While it can be used for unforeseen medical expenses, it’s not necessarily earmarked just for those occasions.

“Emergency can mean that your truck broke down,” Westman says. “You have a blow out and you have to spend $250 on a new tire. That’s not budgeted into your expenses. Those are emergencies.”

Although the career you have chosen carries significant injury risks, sometimes it’s not you who is in need of medical attention.

Farrier Takeaways

Regardless of your station in life, it’s important to have a business plan to guide your decisions.

When setting business goals, be sure that they are clearly defined and reasonably attainable.

With the injury risks involved in farriery, it’s critical to establish an emergency savings account that will cover a year of living expenses.

Paying down debt can be attained by following either the snowball or avalanche methods.

“My mother had a brain aneurysm,” he explains. “I had to fly across the state for 6 weeks. I lost about $10,000 of income. My emergency account saved me. I drained that account, and that’s what it’s there for. It’s not just for injury. It can be anything that comes up that’s not budgeted.”

There is no hard and fast rule about how much you should set aside for that rainy day. Many experts advise 3 to 6 months of living expenses. Don’t forget, though, you’re a farrier.

“I say a year,” Westman says. “In our business, you can get knocked out in a hurry. Any significant injury is going to put you out of commission for a while.”

When starting an emergency savings account, be sure to shop around for the best deal for you. Sometimes it can be found in unconventional sources.

“I keep my money in an online bank,” Westman says. “It pays an interest rate that’s 10 times higher than my old local bank.”

At all costs, avoid using your general savings or checking accounts.

“Keep that money separate,” he says. “If you don’t see it, you won’t spend it.”

Debt Control

Unless you pay off your credit card each month, it’s best to ditch plastic in favor of paper. A mountain of credit card debt can quickly emerge from a molehill.

“If you have any debt, you can get out of it,” Westman says. “Debt affects your bottom line. You are paying with someone else’s money. In an emergency situation, it’s a great fall back source, but I don’t like paying interest.”

There are two effective ways to dig yourself out of debt — the snowball method and the avalanche method. Each achieves the same results, albeit while taking different paths.

Snowball method. Westman developed a plan to get out of debt; only he didn’t know it already existed.

“I had this great plan that I put together,” he says. “Then I realized that someone else already put it together and I realized I wasn’t as brilliant as I thought.”

Before beginning the plan, continue making your minimum payments and make sure your emergency savings is in order. That ensures that you have a safety net.

Sit down and make a list of all your debts in order of the balance owed — the smallest first.

“You want to concentrate on paying off debt with the smallest balance first, while making the minimum payments on the remainder of your debt,” he says. “Those small victories work on your human psychology. The method gives ongoing positive feedback on your progress toward eliminating your debt.”

Life Data Labs Welcomes Farriers To Its Headquarters

Chris Turner honors the late Red Renchin by saving a seat in the front row at the American Association of Professional Farriers Hoofcare Essentials Clinic at Life Data Labs in Cherokee, Ala.

Life Data Labs rolled out the red carpet in mid September as host of the American Association of Professional Farriers (AAPF) Hoofcare Essentials Clinic.

Plant Manager Phil Oliver gave personal tours of the Cherokee, Ala., production and storage facility before kicking off the clinic.

“What an amazing setup,” says Dave Farley, Coshocton, Ohio, farrier and president of the AAPF. “The entire Gravlee family are such gracious hosts. It will be hard to ever have another facility and a clinic like this. The tour was amazing. We are so fortunate to see such an operation. This is the result of years of good, proper planning with a great product.”

Life Data Labs founder Dr. Frank Gravlee expressed his gratitude to farriers for the service they provide the horse.

“I appreciate so much that so many in the farrier industry came to visit our facility,” he says. “It’s a great honor to me to see all these people here who are interested in helping the horse. We want to help farriers help the horse.”

The facility operates with state of the art equipment to produce all of the materials in the familiar Life Data Labs green packaging.

“This is a far cry from the start when we were using a galvanized tub and a canoe paddle to mix the product,” says Dr. Scott Gravlee, a veterinarian and nutrition consultant.

“I didn’t have any way to give the product to farriers, so I went to McDonald’s and Burger King and got them to save their pickle and mayonnaise jars so I would have gallon jugs,” Dr. Frank Gravlee recalls. “I washed those out and that’s what I used to package the materials.

“I’m very blessed to see the operation go all the way from a canoe paddle and a galvanized tub to what you see here and still be able to control the quality and control the company 100%.”

Before the start of the clinic, Adamsville, Ala., farrier Chris Turner honored the late Red Renchin with a touching gesture by saving a seat in the front row for the Hall Of Fame farrier and American Farriers Journal technical editor. Renchin, who suddenly passed away Aug. 29, 2015, was an enthusiastic attendee of clinics around the country. When he wasn’t teaching at a clinic, Renchin could be found sitting in the front row — learning. For memories and tributes about Renchin, please see Pages 4 and 24 to 25.

Once you get the first paid off, move onto the next smallest debt owed.

“Then you take the money you were paying toward that first loan and add it to the minimum balance of the next smallest balance,” he says. “It snowballs; it builds. By the time you get to that truck payment you want to tackle, you’ve got an extra $400 or $500 you’re adding to that.”

The method worked for Westman.

“I was out of debt in 2 years,” he says. “I had two truck loans and a mountain of credit card debt and never looked back.”

Avalanche method. As with the snowball method, you should ensure that your emergency savings is in order and you continue to make the minimum payments on all of your outstanding debt balances.

Similarly, list all of your debts, but this time they should be placed in order of the highest interest rate.

“Then you concentrate the extra debt payment to the balance with the highest interest rate first,” Westman says. “A lot of credit cards have 30% interest rates. That’ll kill you. The laws are changing now that require the lending institution demonstrate that if you make the minimum payment, it’s going to take you 30 years to pay it off. It makes no sense. That money could be sitting in the bank making you money.”

Just like the snowball method, you apply the amount from the first balance to the minimum balance of the next highest rate.

“The snowball method worked best for me,” he says. “You can go either way. You just have to figure out what works best for you.”

The snowball method offers faster mental rewards of paying off a debt, even though it’s smaller.

“When you get that first balance paid off, well, that feels pretty good,” Westman says. “I’m goal oriented. I got fired up for that next one.”

By paying off the smaller balances quickly, it offers the sense that progress is being made.

“It helps you build momentum by repeating rewards at faster intervals,” he says. “It might help you stick with this plan better if you hit those goals and build momentum.”

Although it seems like you’re getting off to a fast start paying down your debt with the snowball method, it’s actually a bit of sleight of hand involved.

“With the avalanche method, the overall debt actually gets paid off faster,” Westman says. “And the savings in interest rates are going to be big.”

To help determine which method is best for you, Westman suggests visiting the website unbury.me.

“The site allows you to punch in all the debt you have,” he says. “You can compare the different methods together. It will show you how fast you can get out of debt and how much interest you’ll be paying. It really gives you some great numbers. It’s a great visual.”

Post a comment

Report Abusive Comment