It’s been said that horseshoeing is a necessary evil, but the same can be said about farrier accounting. The thought of sitting down to do my bookwork is about as appealing as working on an old broodmare in a muddy lot. If you find equally distasteful, it is essential to make keeping your books as easy and efficient as possible.

Just as horseshoers have different styles and needs in their operations, I find that what works for me doesn’t necessarily mean that other farriers also will find my techniques useful. Accounting can be as simple or as complex as a person wants.

The Essentials

Before you figure out how to keep your records, you need to understand the basics of what you need to track:

- Client Information. This includes your clients’ names, addresses and phone numbers. Be sure to get home, cellular and work numbers from clients. If you use a computer, get their e-mail address, too. This can help you later, should you need to simultaneously contact multiple clients on issues such as achieving certification or if you change your phone number.

- Horse Information. Here you’ll list the horses, their owners, when the horses were last worked on and what they will need next time. The latter will be important for when you need to bring equipment on the barn call the next visit. Be detailed about what you did with each horse, as it will help you provide the client with a detailed bill. You may want to include other information here, such as the client’s preferred veterinarian.

- Income. For each client, list the money you have made, as well as what you are still owed. Be sure to record the dates for when you notified the clients of any outstanding bills.

- Expenses. Detail how much you have spent on each job and on what items. Account for everything from the nails driven to the shoes used to pads or any other extra item. It is important to be detailed on what you have done for each horse, as it will help you itemize what you spent per horse when trying to understand your overall costs.

Low-Tech Options

High- or low-tech, make sure you accurately track the information on your clients horses. Try to maintain records with immediate entries into your system.

It is not necessary to have a high-end bookkeeping system for a farrier business. In the B.C. (before computers) years, I used a very simple system that was very affordable, eco-friendly (I used up fewer trees than I do now) and efficient. With $50 and one trip to the office supply store, you will be in business.

To keep track of clients, an indexed address book is required. This allows you to add and remove clients so it doesn’t fill up with useless information.

Next, you will need invoice pads. You can buy these at local supply shops or print shops. You can find invoice pad suppliers in the American Farriers Journal Farrier Supplies And Services directory, published every year in the November issue.

Also, buy some carbon paper to make copies of the invoices for the clients who pay later. This way you have an exact record of what you left with them. That carbon copy is important for recordkeeping if there is a later question or dispute about the bill. When you write an invoice for someone who is going to pay while you are at the barn, a carbon copy is not necessary.

To store the carbon copies of the receivable invoices, buy an indexed folder with pockets labeled from A to Z. When the checks come in, the carbons are removed. Periodically, usually at the end of the month, go through the folder and see who has unpaid bills.

To track income, use two different books. First, you have the daily work sheet to tally each day’s income. Second, use the carbon copies from your deposit slips to tally your monthly income.

What I Do

On the road, I use my daily book: a three-ring binder with indexed dividers that holds the information that I need while away from my office.

In the front, I keep my daily log. This is a record of every horse I work on each day, what I did to each one and what I charged. When this page is filled, I transfer it to another three-ring binder at home. I must keep this up-to-date and accurate for future reference.

Behind my daily list, I keep my “need” and “to do” list. I check this list before the next day’s work to remind me of what I need to restock or special things to do.

To track the horses I work on, I keep individual sheets for each stable on 8.5-by-11-inch card stock. I create a grid with the horse and owner names along the left side and then 12 columns to the right that are labeled for each month. When the horses were done, I mark the date and what was done in an abbreviated code. Each week, I check the dates to determine which horses were due at each location.

I also keep a list of phone numbers of clients and contacts, which are also stored in my smart phone’s directory.

I keep a price list of what I charge different clients, which I update on January 1 of every year. I do this because I don’t charge everyone the same price for comparable work. My charges are based on several factors, such as how far I have to travel, the value and importance of the horse, working conditions, payment promptness, length of relationship and the pain-in-the-butt factor.

Always think about what you charge and consider the potential pitfalls from giving discounts for your work. One thing I have learned is when you give a discount for work, people remember the discount price and will resent being charged the regular price again.

I also carry a large calendar for recording future appointments. I prefer scheduling appointments for sometime during a specific week rather than a specific day. This allows me flexibility to schedule my time more efficiently rather than commit to a certain time or day. How you do this will depend on your clients. Some will prefer an exact date. Regardless of a day or week, commit to it and show up when you say you will.

If you have a bad memory like me, you can invest in a recipe card box and cards. These come in very handy for recalling specific details on horses, such as identifying marks, angles and lengths, types of shoes, soundness issues, etc. This was not my idea. Standardbred racehorse trainers used to keep cards on their horses so when different farriers worked on the horses, the results would be the same.

For tax purposes, it is very important to track all deductible expenses. The old reliable method of storing receipts in a shoebox will still suffice. When it is tax time, everything is sorted out and tabulated.

High-Tech Options

Today, computers are common tools found in many American households. If you are a member of one of these homes, you could purchase software to equip your computer.

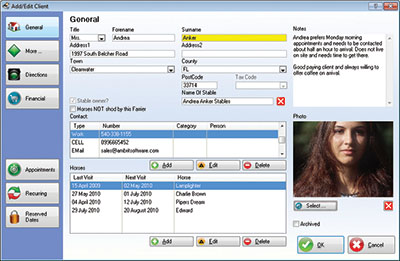

Use of farrier computer programs is becoming more of the norm among shoers. Two include Farriers Manager (www.farriersmanager.com) and Forge Ahead (www.backroadsdata.com).

Which one is the best? It all depends on whom you ask. They provide the means to keep track of all the essentials plus a whole lot more. You can integrate you financial and client information records in one program. You can easily store de and reference detailed information on your clients and their horses. Many software companies offer a trial before you purchase them. In my unscientific survey of farriers using these programs, most users seemed happy with their particular program. Again, everyone has a preference for what works best for them.

Computer programs like AmBrit’s Farriers Manager allows quick access to combined detailed records concerning your clients and their horses.

Smart phones may soon be as prevalent as home computers. The phone is important for client communications, but the handheld computer portion affords greater usage. Right now, there are no farrier programs available for contemporary smart phones. If you do find a program or “app,” beware, as it may not match the quality and support of dedicated computer farrier software. Nor may the company that produced it have a vested interest in farriers as those who currently produce farrier-oriented software for computers.

There are other accounting-only programs that aren’t developed by companies who understand the farrier industry. They do not integrate the client and horse information like the farrier-specific products. In my system, I separate client/horse and financial tabulation systems.

For tax purposes, I use TurboTax. The advantage of this program is that it links to my QuickBooks program data, making the transfer of information seamless.

The digital age can also help you document and share information with your clients. With affordable, point-and-shoot digital cameras, you can quickly capture before-and-after views. This also is a good way to document progress of those troubled feet you inherited. As you develop a portfolio, you can show this to potential clients.

If you are a computer user, you can use one of several free programs out there to manage these images. If you own a home computer, a photo management program probably is already installed on it.

If you record images of your horses’ feet, follow the advice of North Carolina farrier Martin Kenny. He believes the key to success in photography of hooves is to achieve a consistent, similar shot of each view. And having captured more than 17,000 images of feet, he has learned a great deal from the records he’s captured.

“Take pictures of feet that weren’t successes,” advises Kenny. “You learn from pictures of what went wrong, not from what went right. When you realize that, you’ll begin to grow.”

Paying Someone To Do It

Another option is hiring a professional to do your bookwork. In the time it takes you to shoe a horse, you can pay someone and have the accounting job done better than what you would have probably done.

This may make sense when you have more income. Having someone else do your accounting can free up time that you can spend with your family or furthering your hoof-care knowledge.

To find a competent accountant, ask other farriers in your area who they are using. Someone who is familiar with shoeing will easily recognize your business expenses.

There is nothing worse than the “coulda, woulda, shoulda” moment when you know you have screwed up. I strongly advise anyone entering the farrier industry to consult a certified public accountant familiar with small businesses very early on to avoid problems down the road.

I know money is tight starting out, but learning the intricacies taxes from a professional is a smart investment, as it could save you an uncomfortable visit with the tax man.

Determine What System Works For You

One of the benefits of being an independent businessman is the ability to make decisions based solely on what you want to do. This applies to how we conduct our businesses and ourselves. It all comes down to making our own decisions that we think are correct.

How we want to shoe our horses or keep track of our business is entirely up to us. Based on our circumstances it is all about maximizing our time, energy and resources. As with all things in life, stay honest, keep it simple, keep it current and don’t sweat the small stuff.

Post a comment

Report Abusive Comment