Drew Morales

If you use your vehicle for both business and personal purposes, you must divide your expenses between business and personal use. You can divide your expenses based on the miles driven for each purpose.

While both standard mileage rate and actual vehicle expenses are two great ways to get tax deductions, you can’t use them jointly or switch between the two. For example, if you choose to use the standard mileage rate for a year, you cannot deduct your actual expenses for that year except for business-related parking fees and tolls.

Also, if you want to use the standard mileage rate for a vehicle you own, you must choose to use it in the first year the vehicle is available for use in your business. In later years, you can choose to use either the standard mileage rate or actual expenses. If you use the standard mileage rate for lease, you must choose to use it for the entire lease period (including renewals).

See It, Try It and Deduct It

Now that we have a basic knowledge of vehicle deductions, let’s look at a practical example. This will help you understand why tracking both deductions through the year is beneficial. Comparison will tell you which provides the best results for your practice.

Farrier Takeaways

You can choose either standard mileage rate or actual expense deduction, but the two cannot be used jointly or switched in between.

Smartphone apps can help track your mileage for tax reporting.

The percentage of time (based on miles) that the vehicle is used for business determines the deductible portion of these expenses. Here’s a breakdown:

Assume that the gas, oil and repair costs came to $3,000 for the year. Fees and taxes were $500. Loan interest and insurance were $1,500. If it’s an old car, there is no depreciation write-off. Your total “actual” expenses were $5,000.

Your total mileage was 18,000 and documented business miles were 16,202. The business-use percentage is 90% (16,202 divided by 18,000).

16,202 (business miles) x 0.56 (IRS mileage rate) = year deduction.

How your mileage could be tracked and data collected from an app.

If using the actual expenses method, you could deduct $4,500 (90% of $5,000). Using standard mileage rate, your 2014 deduction would be $9,073. So in this case, the standard mileage method gives the larger tax benefit.

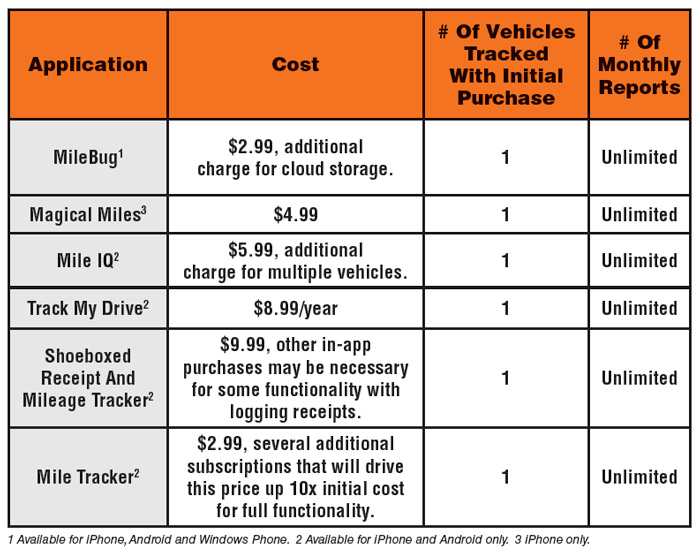

To help make this error free and legal, you must meticulously log miles and collect all auto expense receipts. For logging miles, you can use an old-fashioned logbook. Technology has made things simpler and there are several smartphone applications available for tracking mileage. These apps use built-in GPS technology to automatically track mileage. The table below provides some popular options.

Be careful selecting which apps to test. While the initial charge may appear to be a few bucks, add-ons for full functionality or multiple-year use drive up the true cost of some of these apps in excess of $50. Examine the “in-app purchases” statements of any app to understand what the true cost will be.

Once you’ve picked an app that works for your business and have begun to track your mileage, you must manage the collected data. Many mileage tracking apps include the ability to export data into a spreadsheet.

Tips From A Tax And Footcare Pro

Buck O’Neil is a certified journeyman farrier and a tax expert — he holds a master’s in taxation. In discussing this article with me, O’Neil lent his insight on a few other points:

- In a two-vehicle household, sometimes the second vehicle is occasionally used for business-related matters. Even if the primary business vehicle uses actual cost for expenses, the second vehicle may use standard mileage rate with appropriate documentation.

- The apps are handy for helping with record keeping and they do the math, but it is still critical to maintain all receipts and documentation regarding the vehicles and their upkeep. The IRS may not question a tax return until years later. If the documentation doesn’t support the return, the IRS will win and you’ll lose.

- Well-documented vehicle expenses aren’t just for income taxes. A vehicle may be the biggest expense a farrier has, and knowing just how much it costs is critical to price his/her rates for their services.

- An additional tax write-off is mileage driven in support of charitable organizations. The 2015 IRS rate for this is 14 cents per mile. This could come in handy if you volunteer at a horse rescue on your off days, or do any sort of volunteer work on your own time.

- Driving to educational events also can be a write off as long as the courses maintain or improve your job skills. This includes contests, certifications, clinics and conventions. Again, the IRS will require proof, so be sure to log mileage and fees, and keep receipts.

Spreadsheets allow you to easily export or copy data (this is especially helpful for your accountant during tax season). If your business requires a mileage tracking solution for all of its employees, say a multi-farrier business, then consider an app that includes an account management system. These apps can track an entire fleet of drivers using different vehicles at different rates.

A No-Brainer

Logging your miles is a simple and smart way to earn a tax deduction at the end of the year. Be diligent, check your math and consult with your accountant at least quarterly to ensure you are prepared before the tax-time deadline.

References

- irs.gov/pub/irs-pdf/p334.pdf (Pages 31-32)

- irs.gov/pub/irs-pdf/p463.pdf (Pages 15-30)

- turbotax.intuit.com/tax-tools/tax-tips/small-business-taxes/driving-down-taxes--auto-related-tax-deductions/inf18123.html

- turbotax.intuit.com/tax-tools/tax-tips/small-business-taxes/business-use-of-vehicles/inf12071.html

- forbes.com/sites/kellyphillips erb/2014/09/25/back-to-school-2014-deducting-miles-for-business-medical-moving-charity/ smallbusiness.chron.com/android-app-track-business-mileage-63785.html

- mycartracks.com/pricing

Post a comment

Report Abusive Comment